Retirement savings scheme in the Netherlands

In the early 2000s, the Dutch government - and those of many other EU member states - was growing increasingly concerned about the shift in demographics towards a large ageing population in the country, one that would strain the national pensions' system. An economic downturn in the Netherlands added to these anxieties.

To address these challenges, in 2001 the government designed the Life Course Savings Scheme (LCSS), encouraging the employment of older workers and of women. The scheme also aimed to replace the costly existing scheme and to abolish the fiscal support for early retirement schemes that had been agreed between unions and employers' associations. Unions strongly opposed fiscal reforms, leading to years of negotiations and modifications of the initial proposal. The final version of the LCSS was introduced in 2006 with fewer reforms than originally intended. Moreover, the new programme inadvertently became an alternative scheme to early retirement, failing in its original purpose. The scheme was abolished in 2012 to leave way for a new programme.

The initiative

In response to these challenges, the Dutch government introduced the Life Course Savings Scheme (Levensloopregeling, LCSS) in 2006. The scheme aimed to increase the participation of older workers and women in the labour force by improving their work-life balance. It was originally designed to replace the more favourable SSS and combine it with the abolition of fiscal support to VUT and pre-pension arrangements. LCSS participation was a legal right by which employees could voluntarily save up to 12 percent of their annual gross salary free of tax. Accumulated savings could be used, for example, to finance early retirement or periods of unpaid leave in the family stage or “rush-hour” of life.[7]

The Ministry of Social Affairs and Employment released the first study of the LCSS in 2001, incorporating the scheme in the Dutch political agenda. The innovation of the LCSS was that it made employees responsible for the funding of unpaid leave and early retirement, without losing their employment relationship.[7] The state's support of the LCSS was restricted to promotion and fiscal support of the policy, leaving the ultimate responsibility for regulating and implementing specific measures to collective agreements between social partners.[13]

However, the unions strongly opposed the proposed reforms affecting VUT and the SSS. Following years of negotiations, an amended version of the LCSS was finally introduced in 2006. The final agreement was somewhat restricted compared to previous systems, and did not replace them as originally intended.[7] The LCSS and the SSS were abolished in 2012 with the proposal of the Vitality Scheme, which did not support early retirement.[17] The LCSS agreement was signed on 6 November 2004, with a one-year transition period before full implementation on 1 January 2006.[20]

The challenge

The market system in the Netherlands has favoured early retirement since the 1970s. This popular practice resulted in a low participation of older workers between the ages of 55 and 64 in the labour market and, combined with the low engagement of female workers, this accelerated the problems associated with an ageing population. Around the turn of the century, the government was facing rising concerns over the financial sustainability of retirement schemes and the need to increase labour supply.[3]

The occupational pension as an employee benefit has been one of the three pillars of the pension system in the Netherlands, the other two being the state pension introduced under the AOW National Old Age Pensions Act and private pensions, which are incentivised through tax benefits.[1] Among occupational pensions, the most popular instrument was the “Voluntary early-retirement” (VUT) with 100 percent enrolment of people aged over 55, as of 1997.[3] VUT schemes were very popular as a means for the older generation to make way for a younger workforce, thus helping to alleviate unemployment among the young. It was also popular with employers, as it allowed them to retire members of a less productive labour force. VUT was introduced in the 1970s as a private agreement between unions and employers. It was part of a complex package of labour demands and conditions achieved through collective bargaining. As such, the state had no involvement in this pension instrument other than indirect intervention via fiscal support.

Besides pension schemes, in the 1990s the government aimed to stimulate employee savings, and it introduced the voluntary Salary Savings Scheme (SSS) in 1994, which turned out to be a significant fiscal burden on the state. The scheme allowed tax-free savings that were held in a bank account for four years. After this period, the saver could cash in the saved amount free of tax. The SSS was very successful and six years after its implementation 43 percent of employees were participating in this scheme. Although all income groups benefited from the fiscal advantages of the SSS, higher income groups profited the most.

The fiscal burden of this scheme on the government eventually led to the taxation of the SSS in the early 2000s, making it more costly for employers whose payroll tax increased from 0 percent of the deposit to 25 percent. Also, a reduction of the maximum annual contribution made the scheme less attractive to employees.[11]

After 2000, the Dutch economy entered into a recession, the longest since World War II, and unemployment rates increased above the EU average. The government responded with austerity programmes aimed at managing the increasing public deficit.[7] Moreover, the fall in financial market prices put pressure on Dutch pension funds, causing an increase of contributions in many schemes to return to the desired level of reserves.[1] During this period, the European Commission issued a warning to Member States, calling for labour market reforms. The objective was to adjust to the ageing population in Europe and to encourage higher rates of female participation in the workforce.[16] The role of VUT in developing an “early-exit culture” in the Dutch labour market for over 20 years and the fiscal burden of the SSS were reviewed in this context.[3]

The public impact

The LCSS was designed to make employees responsible for their own savings and pensions. However, in comparison to previous schemes, such as VUT, the LCSS was less popular with the ageing workforce, due to a greater dependency on the employer, limited freedom of spending, and fewer saving possibilities for low-paid workers.

Taking leave was not an employee right, and LCSS participants needed confirmation from their employer, which prevented the enrolment of self-employed workers. If leave was not granted, workers could only use the LCSS for early retirement - what is more, taxation of the scheme actually encouraged its use for early retirement. Also, the use of the LCSS for study leave was not supported. As a result, 50.3 percent of participants mentioned early retirement as the primary motive for joining the scheme, whereas the reason given least often was study leave.

To address some of these shortcomings, changes were announced in 2007 to expand the coverage of the LCSS to incorporate people without employment contracts (i.e. the self-employed) and extending the types of leave for which LCSS could be used.[17]

Overall, in the six years the LCSS was active, employment rates of older workers increased from 48 percent in 2006 to 58 percent of the total population in 2012.[16] However, by 2010 over half of participants reported early retirement as the main reason to take up the LCSS. These findings led to the proposal of the Vitality Scheme, which did not allow fiscal support for early retirement.[2]

Written by Cristina Figaredo

This case study is part of a series of international policies that focus on easing the transition to retirement and later life. The case studies and the accompanying report were produced for the Calouste Gulbenkian Foundation (UK Branch).

Stakeholder engagement

The initial versions of the LCSS which were drafted in 2001 were designed to replace costly but popular schemes such as the SSS. Unions strongly opposed this initiative as it would have cut EUR1.2 billion of state support to social policy. Following the 2003 Coalition Agreement, the second Balkenende cabinet proposed a reformed LCSS that allowed the coexistence of the LCSS and the SSS with some restrictions. This version also incorporated the abolition of fiscal support to VUT and pre-pension arrangements, as well as an opt-out clause for employees saving for early retirement. Trade unions rejected this version of the scheme, considering that it undermined solidarity between generations. Without VUT or pre-pension schemes, they expected well-off employees would be the only ones to benefit.

The central accord achieved in the autumn 2003 tripartite consultations helped unlock negotiations between the government and the social partners. Despite union opposition, a core theme of the 2004-2005 central accord was the wage moderation requested by the government in response to the economic downturn. In return for the unions agreeing to wage moderation, the government-planned cutbacks in important social security policies were to be less stringent. Also, the parties committed to reach an agreement by April 2004 on pre-pensions, early retirement, and LCSS regulation.[7]

The subsequent negotiations in early 2004 failed because unions refused to accept the opt-out clause requested by the government. As a result, that summer the government unilaterally decided to replace fiscal support for early retirement with the LCSS, and attempted further changes of collective labour agreements.[7] The social partners reacted by mobilising the population, and on 2 October 2004 Amsterdam hosted the second largest demonstration against government policies since World War II.[14]

On 11 October 2004, a parliamentary audit was held in which independent legal and financial experts challenged the initiative. The government adapted the reform agreement, and talks were resumed, leading to the new “central accord” in November 2004 whereby the cabinet, unions, and employers' organisations agreed on a revised LCSS.[14] The deal achieved included an early retirement option, tax credit to attract low-income employees, an increase in the maximum yearly savings amount, and a softer transition arrangement for older workers.[7]

Although a policy encouraging labour supply and participation responded primarily to a long-standing internal debate around national reforms, policymakers also aligned with external stakeholders. In Stockholm in 2001, the European Commission recommended that a number of countries, including the Netherlands, reform tax-benefit and early retirement systems to increase labour supply and participation. In response to the Commission's recommendations, these objectives were incorporated in section 2 of the ‘Autumn agreement and consultation with social partners of the 22nd of September 2004'. The agreement further echoed the international actors the International Monetary Fund and the OECD in stressing the importance of increasing the employment of older workers.[20]

Political commitment

In 2006, all the major political parties supported the LCSS in parliament, both in the Upper and Lower House debates.[14] The LCSS was implemented in combination with other labour reforms, including the Labour Capacity Act (WIA) and amendments to the Unemployment Insurance Act. These changes responded to public demands for improving the conditions of work and care. The broader labour reforms included a government commitment to allocate EUR130 million to childcare to improve work-life balance and, within three years, to increase by 25 percent the number of people able to combine work and care.[19] In this context, the broad support for the labour reforms is hardly surprising.

However, in subsequent years the government changed the conditions of the saving schemes several times. Also, when finally abolishing the LCSS and the SSS in 2012, the government did not deliver the new Vitality Scheme programme that had been announced for 2013, pleading budgetary constraints.[17]

Public confidence

In the early 2000s, the political environment in the Netherlands was fragile, as public distrust and growing uncertainty about political institutions emerged. In April 2002 the Kok Cabinet, the first to present an LCSS proposal, stepped down. Then, in the run up to the May 2002 elections, Pim Fortuyn, leader of the eponymous right-wing Fortuyn party, was murdered.[12] The government formed that year was the first Balkenende Cabinet coalition, which collapsed three months later. In early 2003, the Balkenende II-coalition was formed and was the one to achieve the 2004 LCSS agreement.[14]

The Balkende II Cabinet had positive expectations of labour force enrolment in the LCSS. In 2004, it forecast an annual average participation rate for 2006 of 20 percent of the labour force, or 1.9 million employees, increasing to 33 percent or 3 million employees by 2009.

Despite several ex ante studies supporting the government's positive expectations, other studies estimated rather lower participation rates (0.1 percent of the labour force, or 17,000 employees) because of the SSS being more advantageous for workers.[6] See the Alignment section below for research on the reasons for low participation rates.

To build trust in this initiative, the government provided online tools allowing employees to calculate their accrued capital and the leaving period it could cover.[19] However, the tools' success cannot be accurately assessed, due to a lack of statistics about their use.

Clarity of objectives

Throughout its drafts and proposals, the Balkenende II Cabinet stated the following objectives:

- Stimulating the employment of older workers

- Improving the work-life balance in the family stage or “rush-hour” of life

- Abolishing fiscal incentives to pre-pension and early retirement schemes to alleviate state costs.[20]

These objectives were pursued throughout the duration of the policy from 2007 to 2012. However, the government's aim of abolishing long-standing tax incentives was only partially clear, as new pension tax incentives were implemented with the LCSS.[18]

Moreover, in response to the European Commission's recommendations of 2001,[4] the Dutch government incorporated a target of increasing the participation rate of people aged 55-65 from 38 percent in 2003 to 50 percent in 2010.[20] These targets were later adjusted to a net labour force participation of older workers (55-64 years) of over 40 percent in 2006 and 45 percent in 2010. By the end of 2006, the initial target was achieved with a participation rate of 41.7 percent.[10]

Strength of evidence

The initial design of the policy evolved, with each of the three governments incorporating it in their agenda between 2002 and 2003. The subsequent negotiations with social partners shaped the initiative further.[14] Nevertheless, there is an apparent lack of evidence of pilot programmes or lessons from previous examples being introduced.

The main tools that encouraged the government to think the policy would be successful seem to have been government studies and surveys indicating a high rate of labour force participation, although several other studies suggested the opposite.[6]

At a European level, in the late 1990s the impact of early retirement as a work disincentive was observed in several Member States, including the Netherlands. In 2001, the European Commission recommended that the countries concerned take steps towards changing early retirement incentives.[9]

Feasibility

Legal and financial experts challenged the LCSS during the parliamentary audit held in October 2003. The scheme was adjusted for the resulting final agreement between the government and social partners.

Nevertheless, in spite of general support for the final LCSS agreement, a number of critics and the political opposition have referred to challenges in relation to the coexistence of the LCSS and the popular SSS, both of which received fiscal support from the Cabinet. Although individuals were not in any case allowed to participate in both schemes in the same fiscal year, the legislation also blocked the transfer of capital from one scheme to the other, potentially preventing SSS participants from taking part in the LCSS. This barrier to capital transfer was seen as an obstacle to saving with the LCSS.[14]

Management

Following the LCSS agreement, the involvement of the Ministry of Social Affairs and Employment was limited to funding the support and promotion of the policy. Unions and employers' associations were ultimately responsible for the implementation of the LCSS and the regulation of specific measures as part of collective agreements.[13]

However, the Ministry oversaw the programme, and in its consultations with social partners several shortcomings were identified.[2] LCSS limitations included a greater dependency on the employer, limited freedom of spending, and fewer savings possibilities for low-paid workers. These shortcomings were later considered and addressed when the Vitality Scheme was being designed.[17]

Measurement

According to the OECD, the Dutch government took substantial action to monitor the use of the LCSS in order to avoid the scheme becoming an alternative route to early retirement.[2] However, there is little evidence to suggest that the government collected data to measure and track the actual impact of the programme.

In 2010, an evaluation of the LCSS indicated that some 50 percent of participants were using the scheme for early retirement, which was the opposite of the programme's objective. As a result, the government decided to gradually abolish the scheme. Although new accounts were not allowed after 2012, participants having saved EUR3,000 or more by December 2011 were to have access to their account until 2021; those who had saved less had their accounts released in 2012 (after taxes had been deducted).[2]

However, there is only limited information publicly available to assess to what extent these metrics were used in refining the government's approach.

Alignment

A key driver of success for the LCSS policy was its degree of alignment with the interests of the labour force. And despite unions' significant interventions in the policy design, the LCSS was not fully aligned with employees' interests. The success of the policy depended directly on the participation of employees, which turned out to be lower than expected and motivated by the wrong reasons, from the government's perspective.

Participation in the first year was 5 percent of the workforce, instead of the 20 percent initially estimated by the state for the end of 2006.[19] In the following years, participation remained low compared to the SSS, which the LCSS was originally intended to replace.[17] Blocking the flow of capital between the popular SSS and the LCSS was identified in the early stages of the programme's design as a potential obstacle to participation, and this concern proved to be well founded.

Moreover, from a rather early stage, the motivation of participants seemed to be counter to the objectives of the LCSS. The DNB Household Survey panel found in July 2006 that 8 percent of its members (2,000 Dutch households)[5] had subscribed to the LCSS. The main motivation for 58 percent of these members was to save for early retirement - a motive that was in conflict with the scheme's objectives. For 65 percent of the group, fiscal benefits were also an important motive, and 31 percent stated that employer contribution played a role as well. Among the reasons given for not participating in the scheme, 31 percent of respondents stated that they preferred the SSS, 16 percent preferred private savings, and 13 percent indicated they could not spare the money.[7]

Four years later, in a 2010 evaluation of the scheme, it was found that over 50 percent of all participants continued to use the LCSS for early retirement.[2] Also, employers' tendency to refuse workers' applications to take paid leave - as outlined in the Public Impact section - further suggests a weak alignment with key LCSS implementation partners. The European Commission also identified a lack of alignment when reporting on the Netherlands in 2012, citing employers' negative attitudes towards the productivity of older workers. The Commission found that a mere 8 percent of employers recruited older employees.[1]

Bibliography

http://ec.europa.eu/social/BlobServlet?docId=5434&langId=en

http://europa.eu/rapid/press-release_IP-01-1264_en.pdf

[5] DNB Household Survey (DHS), CentERdata

https://www.centerdata.nl/en/projects-by-centerdata/dnb-household-survey-dhs

http://www.ru.nl/economie/onderzoek/nice-working-papers/#hdd10f12e-c672-4c2f-8d45-cb7f2923421e

[8] Employment and activity by sex and age - annual data, Eurostat, 23 April 2018

http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=lfsi_emp_a&lang=eng

[9] Employment in Europe 2000, European Commission, 2000

[10] Financieel jaarverslag van het Rijk 2006, Rijksoverheid, 2006

http://www.rijksbegroting.nl/2006/verantwoording/financieel_jaarverslag,kst105371_4.html

http://www.ru.nl/publish/pages/516298/nice_12103.pdf

[12] Infighting leads to collapse of Dutch cabinet, Andrew Osborn, 17 October 2002, The Guardian

https://www.theguardian.com/world/2002/oct/17/thefarright.politics

http://www.eu-newgov.org/database/DOCS/P18aD01_life_course_policies_paper_vdmeer_leijnse.pdf

[15] PES and older workers: comparative paper, Matthias Knut, June 2012, European Commission

http://ec.europa.eu/social/BlobServlet?docId=7816&langId=en

[16] Presidency Conclusions, Stockholm European Council, 23 and 24 March 2001, European Council

https://www.consilium.europa.eu/media/20994/stockholm-european-council-presidency-conclusions.pdf

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2414546

http://www.rijksbegroting.nl/2006/kamerstukken,2005/12/5/kst92168.html

https://zoek.officielebekendmakingen.nl/kst-29760-3.html#IDALRI5

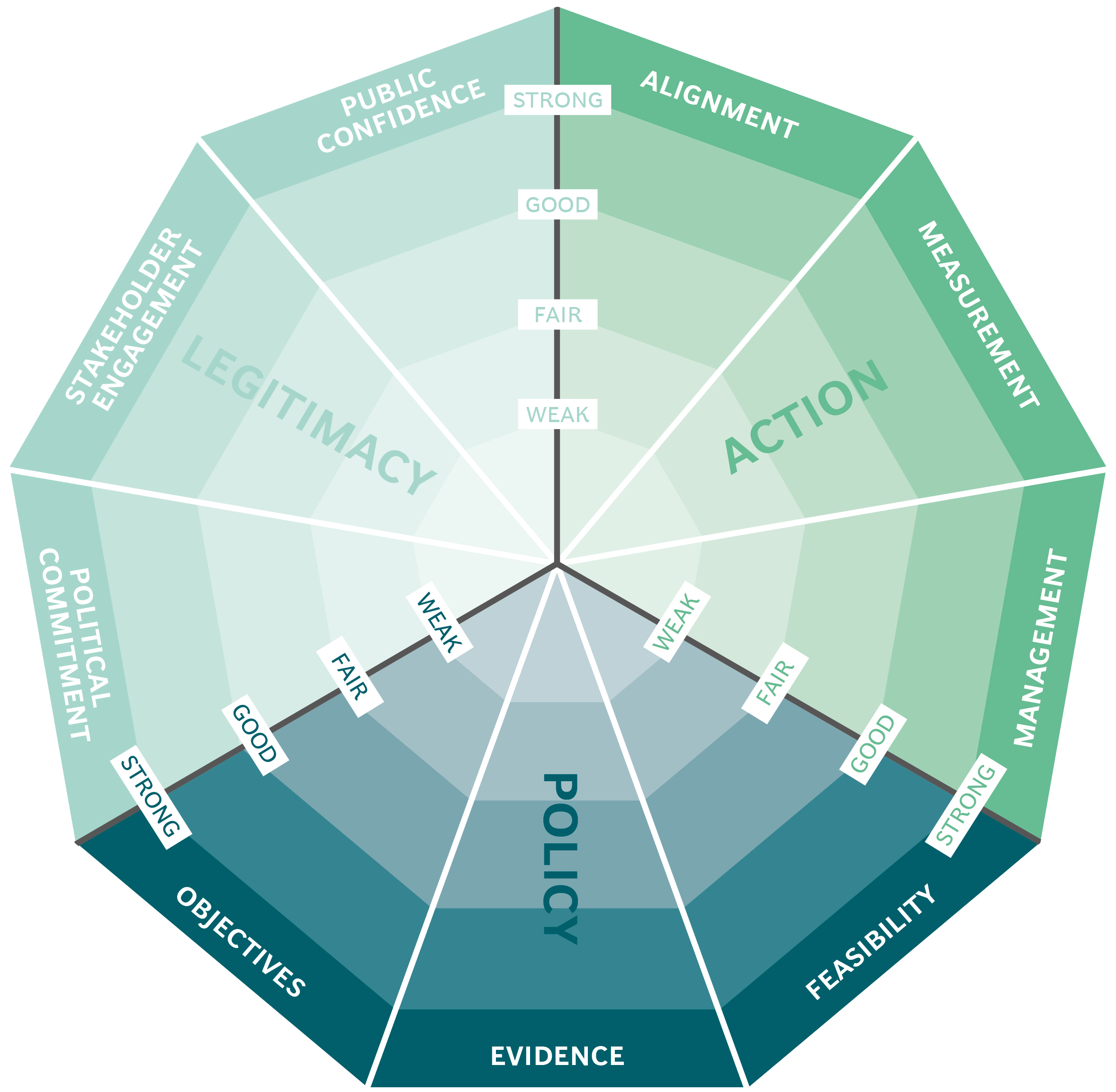

The Public Impact Fundamentals - A framework for successful policy

This case study has been assessed using the Public Impact Fundamentals, a simple framework and practical tool to help you assess your public policies and ensure the three fundamentals - Legitimacy, Policy and Action are embedded in them.

Learn more about the Fundamentals and how you can use them to access your own policies and initiatives.

You may also be interested in...

Mexico City's ProAire programme

BANSEFI: promoting financial inclusion throughout Mexico

Formalising the appointment and compensation of Chile’s senior civil servants

Rainfall insurance in India