The London Underground's failed PPP

In 1998, the recently elected Labour government under Tony Blair initiated a public-private partnership (PPP) to modernise the London tube system, whose oldest parts were over 100 years old. While the underground’s assets stayed in public hands, two private companies – Metronet and Tube Lines – were contracted to attract investment and carry out the work. In 2007, the PPP failed and its liabilities were underwritten by the government, leaving the British taxpayer with losses estimated in billions of pounds.

The initiative

In 1997, therefore, the incoming Labour government rejected the Conservative privatisation plans in favour of a PPP. However, it did not want to abandon the existing spending plans: "the new Labour government was determined to keep overall spending... within strict limits laid down by the outgoing Tory government".[4]

John Prescott, the Labour secretary of state for environment, transport and the regions, announced the new policy in the House of Commons on 20 March 1998. "In our election manifesto, we rejected privatisation and we promised that we would implement a new concept - a public-private partnership - to modernise the underground, to safeguard its commitment to the public interest and to guarantee value for money to taxpayers and passengers. I can now tell the House how we plan to deliver on that commitment."[5]

The intention was for London Underground Limited (LUL), a subsidiary of Transport for London (TfL), to remain a unified public sector company that “own[s] the freehold of the system; [is] responsible for safety; and, employ[s] train drivers, station staff and line and network controllers”.[6] At the same time, contracts were rewarded to the private sector to undertake the modernisation of the underground infrastructure and deliver the necessary GBP7 billion in investments over 15 years. The UK government announced that it would provide the first GBP865 million in funding for the refurbishment projects.

The initial proposal for the renewal of the underground was:

“Additional track works on the Victoria and Northern Lines;

"Conversion of old Jubilee Line trains for use on the Piccadilly Line with ten new trains available by 2001;

"Replacement of fifteen escalators;

"Refurbishment of thirty stations.”[7]

The three 30-year contracts from the government for tube refurbishment under the PPP were won by Metronet BCV and Metronet SSL — known collectively as Metronet, a private consortium — and Tube Lines Ltd, a private company.

The challenge

In the late 1990s, the London underground was in need of significant investment in its track, stations and rolling stock, which were showing their age, the original underground railway dating back to 1863. With the deteriorating infrastructure came rising costs and the growing inefficiency of the service. "Rails were rickety, trains broke down, signals failed and stations were unkempt and dilapidated."[1]

To finance the necessary investment, the Conservative government wanted to upgrade the existing underground system through a complete privatisation. They stated that this would “deliver a higher-quality underground at an affordable cost to passengers and no extra cost to the taxpayer”, according to the secretary of state for transport, George Young, in a speech to the House of Commons on 25 February 1997.[2]

During the campaign leading up to the May 1997 general election, the Labour opposition argued against privatisation, instead proposing a public-private partnership (PPP) as the most appropriate mechanism for modernising the underground. "Labour... has said it would like to maintain government control of the underground but to attract private investment through partnerships."[3]

The public impact

As far the renewal of the underground itself was concerned, TfL concluded that “despite its failure to deliver the biggest projects, the PPP has nevertheless delivered the renewal and upgrade of many other assets — including track, stations, lifts and escalators”.[8]

By 2010, 26.6km of track had been replaced, 25 escalators refurbished, 2 lifts replaced and 23 stations modernised. According to TfL, within the first five years of the PPP the overall performance of the London underground had improved. “Total Lost Customer Hours - i.e. the aggregate cost of delays due to asset failures in terms of customers' time - had reduced by approximately 20 percent; the volume of train services had increased by nearly 2.8 million km; and in 2007/08 almost 125 million more journeys were made on the tube than in 2003/04.”[9]

However, the financial impact of the PPP was perceived as mostly negative. As costs increased between 2003 and 2007, TfL had to step in and eventually take over all three PPPs itself. "The loss to the taxpayer arising from Metronet's poor financial control and inadequate corporate governance is some £170 million to £410 million."[10]

Estimates of the overall cost of the PPP have varied, but they all indicate significant losses of public money. "The PPP blunder certainly cost UK taxpayers not less than about £2.5 billion and possibly far, far more, possibly in the region of GBP20-25 billion."[11]

Metronet and Tube Lines had collapsed by 2007, expecting to overspend more than GBP1 billion. This debt had eventually to be paid by the UK taxpayer, as LUL bought out the private companies in 2010.[12]

Stakeholder engagement

In 1997, the Labour government was elected based on their “New Labour” manifesto, which included the PPP proposal for the London underground. The government's official policy proposal of 1998 stipulated that a mix of public and private investments was the best option to fund the tube's modernisation.

A majority of stakeholders were against this "partial privatisation". Opposition was led by the Mayor of London, Ken Livingstone, TfL, trade unions, and safety campaigners. They felt that a fragmented management, with LUL employing staff and Metronet and Tube Lines leading refurbishment, would make the underground less safe and less efficient.

London Transport (which became TfL in 2000 under the Greater London Authority Act 1999) conducted their own funding options analysis, which came to the conclusion that the London underground should be owned and financed solely by the public sector instead of opting for a PPP. However, London Transport was not given the opportunity of a hearing to discuss their choice with the government. “Consequently some came to an early conclusion that the PPP funding policy was more-or-less ‘done-deal' politically.”[13]

After the mayoral election of 2000, Ken Livingstone, together with the London transport commissioner Bob Kiley, initiated a legal challenge to the PPP, seeking a judicial review of the government's decision. They feared that the scheme would be unable to provide the desired upgrade.”[14]

In addition, the Mayor's Office supported strikes organised by the biggest rail union, the RMT, indicating a coordinated opposition by local stakeholders. Millions of travellers were affected, as more than 90 percent of the underground service was suspended during a series of strikes in July 2002.[15] This strong opposition contributed in large part to the weak alignment between TfL and the Mayor of London on the one side and the private partners Tube Lines and Metronet on the other (see Alignment below).[16]

Political commitment

Across the political spectrum, there was a broad consensus that private investment and expertise were necessary to modernise the London underground. The issue was high on the agenda for politicians because LUL had reported to the government a backlog in investments of GBP1.2 billion, stemming from “historical under investment in assets which results in service degradation or additional running cost”.[17]

The Conservatives under Margaret Thatcher introduced the privatisation of national public services to the UK in the 1980s, and had been advocating the complete privatisation of the London underground since 1992 (see The Challenge above).

Both parties had addressed the modernisation of the London underground in their 1997 election manifestos, which demonstrates that the issue was high on the political agenda. On the one hand, the Conservatives “promised that proceeds from the privatisation would be recycled in order to modernise the network within five years and that the majority of the remaining surplus from privatisation would be channelled into additional support for transport investment in London and elsewhere in the country”.[18] On the other, the Labour party “stated that the Conservative plan for wholesale privatisation of the London underground was not the answer and proposed its own PPP”.[19]

The incoming Labour government was committed to its campaign promise, and promoted the PPP approach to the renewal of the London underground until its failure became self-evident.

Public confidence

The public entertained mixed feelings about the proposed PPP as the means to refurbish large parts of the tube network. There was broad agreement about the need to invest in modernising the capital's transport and infrastructure, but the public was becoming disenchanted with the scale of private sector involvement in public services.

Public opinion on the privatisation of national companies started to shift during the 1990s. An Ipsos Mori opinion poll from 1989 showed that 18 percent of the UK population considered privatisation to be the worst thing Margaret Thatcher's government had done during the 1980s - after "NHS cuts or lack of funds for healthcare" (35 percent) and the poll tax (19 percent).[19] The Conservative government's last major privatisation project was the controversial sale of British Rail and its network, which was completed in 1993. This left the general public largely opposed to the effects of privatisation, and “fuelled widespread opposition to opening up the last major publicly owned transport provider to the private sector”.[20]

Clarity of objectives

After the announcement of the PPP in 1998, the government commissioned three separate contracts for the upgrade of the London underground between December 2002 and April 2003 (see The Initiative above).[21] These had two main objectives:

Removing the investment "backlog"

Upgrading LUL's assets, including rolling stock, track, signalling, stations, and escalators.

The individual contractors had the following responsibilities for the upgrade:

Tube Lines was responsible “for the maintenance and renewal of the Jubilee, Piccadilly and Northern Lines”.

Metronet was responsible “for the maintenance and renewal of the Bakerloo, Central, Victoria and Waterloo & City Lines [and for the] maintenance and renewal of the 'sub-surface lines' - the Circle, District, Hammersmith & City, Metropolitan and East London Lines”.[22]

Overall, the government estimated that the three deals combined would realise GBP16 billion of investment over the first 15 years.[23] LUL remained a publicly-owned operating company, while the private companies Metronet and Tube Lines committed to the first 7½ years of the PPP. Each deal initially had a tenure of 30 years.

Strength of evidence

The Labour government conducted a broad examination of the financial feasibility of the PPP. In July 1997, a private consultancy was contracted to issue financial advice “within the framework set out in the Labour's Manifesto for the 1997 General Election”.[24] In December 2000, the National Audit Office (NAO) scrutinised the financial analysis. “[They] found there were many factors that were difficult to quantify but would have an impact on outcomes, including the effectiveness of the performance mechanisms, the willingness of the parties to cooperate to alleviate strategic and contractual risks, and effective risk analysis and management.”[25]

LUL had previously rolled out private finance initiatives (PFIs) in the early 1990s to supply a fleet of 106 trains on the Northern Line. The contractor, GEC Alsthom, financed and maintained the trains, while LUL “agreed to pay Alsthom between GBP40 and GBP45 million a year over twenty years”.[26] Based on that experience, London Transport came to the conclusion that not all necessary infrastructure investments for the London underground could be accomplished by private investment. They argued in a 1996 memorandum that crucial infrastructure work and maintaining the financial burden of funding of the tube system could not be achieved by PFIs alone, because they could not "make a major contribution to providing new funds for the underground”.[27]

LUL formally reported these findings during several sessions to the House of Commons Transport Select Committee in February 1997. During these meetings, it emerged that, for the government: “the only ways of reducing the investment backlog… were either increased government grant[s] or privatisation”.[28]

London First, an organisation of London businesses that lobbied the government for transport and infrastructure improvements conducted additional research into setting up a London Transport Trust and keeping the underground as a public interest company. Professor Stephen Glaister from the London School of Economics argued that “a public interest company with a clearly defined legal structure, a definition of its liabilities, sanctions against directors etc. which would be able to borrow on the money markets [would be able to raise sustainable investments]”.[29]

Feasibility

In 2001, Ken Livingstone and his transport commissioner, Bob Kiley, sought judicial review of the government's plans to carry out the work on the tube through a PPP. They believed that a legal challenge was necessary, as the PPP was "prohibitively expensive, fatally flawed and dangerous, because it [involved] separating responsibility for maintenance from running of the trains”.[30] Although this challenge initially affected the legal feasibility of the project, it was not ultimately successful.

LUL faced problems in establishing an effective partnership with Metronet. Initially, as the NAO argued in its official special review report, there were serious ambiguities in the contracts, with a lack of clarity the work that had to be carried out. “The specification for modernisation work, for instance, was only 600 words long and left considerable room for interpretation, leading to frequent, time-consuming disagreements between Metronet and LUL.”[31]

Other parties argued that cooperation between LUL and Metronet was made more difficult because LUL had limited access to the cost and management data gathered by Metronet's component companies. This meant that “London Underground had difficulty... to more closely monitor costs and to understand the effect of its interpretation of the contract scope on project cost increases”.

The Department for Transport (formerly part of the Department for Transport, Local Government and the Regions) was exposed to increasing financial risk by assuring grant payments to Metronet's lenders. “The secretary of state had given assurance to Metronet's lenders which later resulted in the Department for Transport (DfT) making grant payments of GBP1.7 billion to help LUL purchase Metronet's debt obligations”.[33] The DfT later acknowledged that “when giving letters of comfort, the Department should identify the impact on its own exposure to risk, and actively seek to reduce or mitigate it”.[34]

Management

Metronet's five shareholders - Atkins, Balfour Beatty, Bombardier, EDF Energy, and Thames - were also suppliers of most of the construction materials. The National Audit Office therefore argued in their official review on ‘the failure of Metronet' that this created a bias in their decision-making.[35]

In their role as suppliers, the shareholders had power over the scope of the work, and this impacted on the effectiveness of the management structure. “Metronet's management was unable to extract key information or incentivise suppliers to perform their roles in line with its own interests.”[36] This led to a high risk of cost overruns, and the PPP's administrators, TfL, had to slow down some work - such as Metronet's station refurbishment programme - in order to regain control of costs. At the same time, the executive management changed frequently and had only a narrow overview of its costs. This meant that “Metronet was unable to monitor costs and could not obtain adequate evidence to support claims to have performed work economically and efficiently”.[37]

LUL was prone to make late revisions to the project, which gave Metronet problems with their plans, suppliers and materials and was an overall constraint on project management. Throughout the construction phase in 2004, Metronet and Tube Lines employees were of the opinion that “London Underground did not make considerations for 'principles of affordability' in its requirements, in particular with regards to scope demands”.[38]

In one instance, at Northfields station on the Piccadilly Line, "London Underground changed its requirements late in the construction phase. In October 2004, three months before completion of the work, London Underground requested the revision of plans for station operations room windows and doors. Tube Lines estimates these changes added 35 to 50 days to the construction time, because a new manufacturer had to be contracted to provide the revision."[39]

Measurement

The DfT had overall oversight of the project, but it relied on TfL, LUL and the public sector to monitor themselves, which created a "monitoring vacuum". The DfT was responsible for overseeing the PPP contracts with LUL, but had only limited formal mechanisms for conducting adequate risk management. “DfT was not party to the PPP contracts and had no direct influence over performance.”[40] Therefore, the DfT had to rely on LUL, Metronet and the PPP Arbiter - a dispute resolution role created under the Greater London Authority Act 1999, s225 - to monitor progress themselves, which they did not do adequately.

LUL and TfL were responsible for preventing any deviation from the funding plan, but this was difficult because they had problems in accessing accurate cost information. There was a belief that Metronet would monitor its own financial risk, as part of its responsibility towards its shareholders. However, that belief was not well founded, because Metronet's shareholders actually benefited from any contract overruns. The private lenders failed to monitor Metronet's performance, despite being expected to do so: “they monitored the rate of spending, but did not compare it closely to delivery and were therefore slow to identify the extent of cost overruns”.[41]

Alignment

The antagonistic environment created by the Mayor of London's legal challenge to the PPP, as well as the weak management and oversight of the project, created an atmosphere in which there was little cooperation between TfL and LUL, on the one hand, and Metronet and Tube Lines on the other.

The lack of cooperation and trust between these stakeholders damaged the effectiveness of the PPP project. The PPP Arbiter, who became involved in attempting to settle the cost dispute between Metronet and LUL, found that “it is absolutely clear that that concept of partnership has not always operated. The relationship between the two organisations was the poorest he had come across both in his current role and during his time as Chairman of the Office of Rail Regulation.”[42]

Bibliography

Mayor loses bid to block PPP for tube, 30 July 2001, The Guardian

Margaret Thatcher (1925-2013): Public opinion trends, 8 April 2013, Ipsos MORI

The Blunders of our Governments, Anthony King and Ivor Crewe, 2013, Oneworld Publications (see Chapter 14)

Unions threaten Labour with more strikes on Tube, Paul Marston, 19 July 2002, The Telegraph

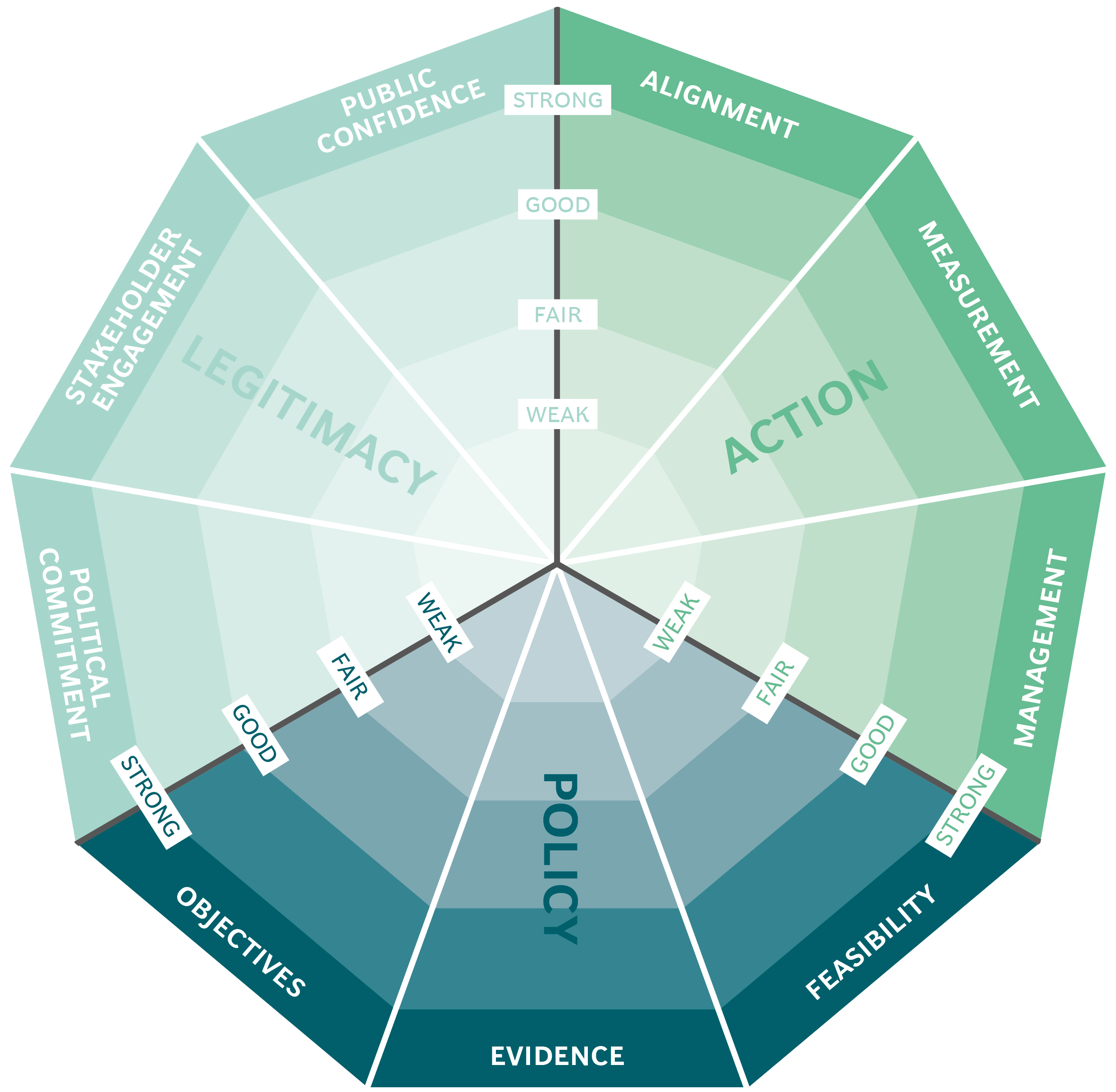

The Public Impact Fundamentals - A framework for successful policy

This case study has been assessed using the Public Impact Fundamentals, a simple framework and practical tool to help you assess your public policies and ensure the three fundamentals - Legitimacy, Policy and Action are embedded in them.

Learn more about the Fundamentals and how you can use them to access your own policies and initiatives.

You may also be interested in...

National portal for government services and Information: gob.mx

Urban agriculture in Havana

The eco-friendly façade of the Manuel Gea González Hospital tower in Mexico City

Primary education management in Madagascar