Nota Carioca: electronic tax administration in Rio de Janeiro

The initiative

Mayor Paes planned to implement an electronic invoicing system, which was based on similar programmes that had been piloted in other Brazilian cities.

He put together a team to address the financial issues facing Rio, and saw the electronic tax system as an important component. The broad requirement was to make Rio's tax collection more efficient, resulting in a streamlined process with significant cost-savings. The specific system requirements were to:

- Implement the electronic tax system in the city.

- Digitise additional tax processes as well as other financial services.

To meet the functional requirements, tax specialists and IT managers:

- Represented Rio's Finance Secretariat in the creation of the national model for electronic invoicing by Associação Brasileira das Secretarias de Finanças das Capitais [the national association of finance secretaries from state capitals] (ABRASF). ABRASF brought together representatives from across the country to create a standard national model for electronic invoicing.

- Acquired a suitable product, which was electronic invoicing software from TIPLAN. (The Commercial Association of Rio de Janeiro purchased and then donated the software to the city's government.)

- Secured data-storage capacity.

- In early 2010, the IT team began the process of customising the TIPLAN software to meet Rio's specific requirements.

The IT solution to the tax collection requirements was called Nota Carioca. It was completed in May 2010, and the team made it available to companies in Rio to register voluntarily, so that electronic invoicing could begin.

The challenge

Before 2010, Rio de Janeiro had a complex, paper-based tax collection system, which was a drag on business as well as being a cause of lost revenue. When Eduardo Paes was elected mayor of Rio in 2009, he saw that there was a pressing need to overhaul the manual system before Rio, Brazil’s second largest city, fell further behind its Brazilian and international rivals.The public impact

From its roll-out in 2010 to April 2014, the system issued more than 400 million electronic invoices. Analysis by the Finance Secretariat in August 2013 showed that the gains from Nota Carioca were BRL686 million (US$393 million) from July 2010 to June 2013.

By mid-2014, Nota Carioca had 143,637 registered vendors and 499,235 registered customers. It has become the city's model for the digitisation of additional tax processes and other financial services.

Stakeholder engagement

Mayor Paes and the senior members of his team – including Eduarda La Rocque, the finance secretary, and Adriano Cereja, the IT manager – took the initiative and were supported by other stakeholders, principally the Commercial Association, which borrowed funds from Banco Santander to buy the software product, and its vendors TIPLAN, which played the crucial role in implementing the system.Political commitment

The programme was initiated by Mayor Paes and continued to have his robust support and that of his finance team, who recognised that any new system would have to overcome scepticism about new technology being planned, (One member, Marcio Luiz Oliveira, delayed his retirement from his job as service-tax coordinator to become sub secretary of taxation.)Public confidence

Eduardo Paes was elected in 2009 on a promise to voters to overcome the city’s financial problems, including tax administration. He was supported in this by the Commercial Association, a group of businesses equivalent to a chamber of commerce. Antenor Leal, the president of the Commercial Association, was a strong supporter of the tax reform initiative.Clarity of objectives

The objectives of Nota Carioca were clearly stated: to convert Rio’s tax collection system from paper to electronic invoicing, as part of a wider initiative to reform Rio’s financial system. The specific requirements of Nota Carioca were clearly defined, matched against the appropriate software product and implemented.Strength of evidence

In the planning stages in 2009, the city administration and designers of the new system studied similar tax collection systems that were already in place elsewhere in Brazil:

- São Paulo, Brazil's most populous city, had implemented an electronic invoicing system two years before, in 2007. Marcia Tavares, the president of Rio's accountancy firms union at the time, said, “Rio had wanted to have something similar for years.” [1]

- Angra dos Reis, a small city 100 miles from Rio, had pioneered a system of electronic invoicing in 2002. Pedro Arroyo, a consultant for Rio's Finance Secretariat, had implemented the system when working for TIPLAN, and was aware that it could similarly be used to meet Rio's similar, but more extensive requirements.

Management

The Nota Carioca project was initially directed by Mayor Paes, he ensured that the project was well managed at every stage. The management team included:

- Senior members of the Finance Secretariat, who had overall responsibility for the reform and brought knowledge of tax policy and process.

- An IT management team, with representatives of IPLANRIO, the municipal government's own IT service provider, who oversaw data processing and storage and incorporated Nota Carioca into the existing IT infrastructure.

Measurement

A number of metrics have been applied to measure Nota Carioca’s public impact, with parameters such as the number of its registered customers, the number of electronic invoices it issued, and the cost-savings for the city of Rio de Janeiro as a result of its use.Alignment

That there was clear alignment between the interests of all the stakeholders and participating bodies was evident in:

- The commitment of Mayor Paes.

- The collaboration between the city's Finance Secretariat and ABRASF.

- The support of the Commercial Association.

- Relations between representatives of IPLANRIO and the IT vendors.

- Relations between the management team, specifically Marcio Luiz Oliveira, and the accountancy firms' union's president, Marcia Tavares.

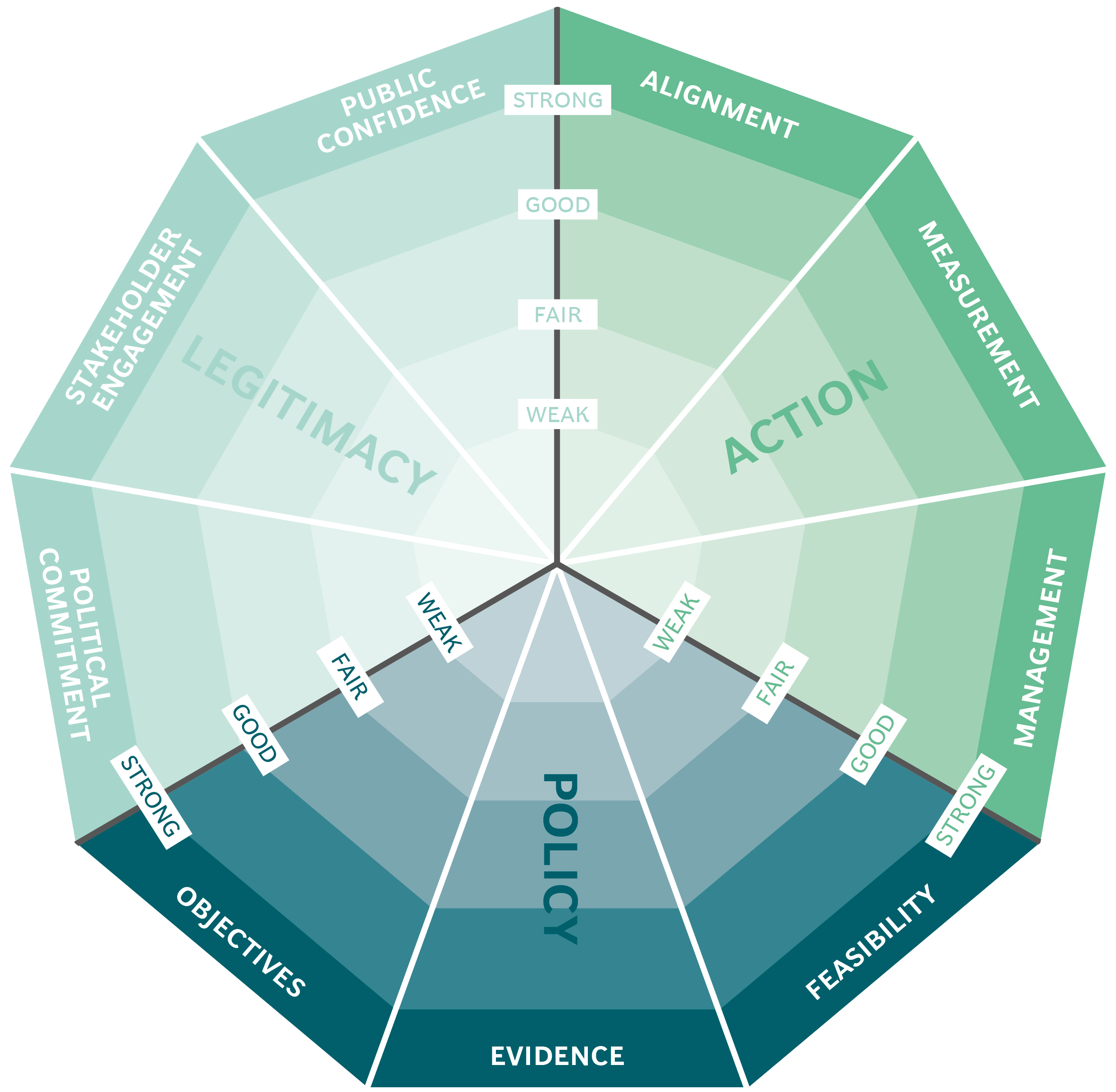

The Public Impact Fundamentals - A framework for successful policy

This case study has been assessed using the Public Impact Fundamentals, a simple framework and practical tool to help you assess your public policies and ensure the three fundamentals - Legitimacy, Policy and Action are embedded in them.

Learn more about the Fundamentals and how you can use them to access your own policies and initiatives.

You may also be interested in...

Mexico City's ProAire programme

National portal for government services and Information: gob.mx

BANSEFI: promoting financial inclusion throughout Mexico

Urban agriculture in Havana