Mobile currency in Kenya: the M-Pesa

The initiative

M-Pesa is a mobile money service that was officially launched in March 2007 by Safaricom, the leading mobile phone operator in Kenya. (Safaricom is part of the UK's Vodafone Group, which owns 40 percent of the company.) M-Pesa was initially developed by Vodafone, and the six-month pilot phase of the project was partly funded by the UK's Department for International Development (DFID).

M-Pesa is an SMS-based system that enables users to deposit, send and withdraw funds using their mobile phone. Customers do not need to have a bank account and can transact at any of the country's 40,000 agent outlets. Registration and deposits are free and pricing for most other transactions is based on a tiered structure to allow even the lowest-income users to use the system. Transaction values are typically small, ranging from US$5 to US$30.

The challenge

In Kenya before 2007, people used a mixture of formal and informal channels to transfer money and relatively few had access to banking and other financial facilities. There was no well-established, trusted and robust network for carrying out financial transactions. It was observed, though, that 83 percent of the population of 15 years and upwards had access to mobile phone technology.The public impact

M-Pesa “grew at a blistering pace following its inception in 2007.” [1] In less than two years from its launch, M-Pesa had become the leading money transfer method in the country, with over 50 percent of people sending money via M-Pesa and over 65 percent receiving funds through the system in 2009. By 2015 there were 19.9 million active M-Pesa users, up 18 percent from 2013/14. It is said that 43 percent of Kenya's GDP flowed through M-Pesa, with over 237 million person-to-person transactions.

There has been explosive growth in the number of M-Pesa agents. From a base of approximately 450 in mid-2007 when the service was introduced, numbers grew to over 18,000 locations by April 2010 and to 40,000 in April 2016.

Stakeholder engagement

Safaricom formed strategic partnerships with organisations such as the Central Bank of Kenya, the Commercial Bank of Africa – for local banking services –and the ATM provider, Pesapoint, to establish ATMs throughout Kenya. The local microfinance company Faulu helped the company to launch the pilot. Additionally, Safaricom received funds from DFID in the UK through its Financial Deepening Challenge Fund (which was established to finance PPP projects that would improve access to financial services). All these made for good external stakeholder support, including engagement in programme design.Political commitment

The Kenyan government owns 35% of Safaricom and this in assisted Safaricom and Vodafone in establishing a strong relationship with the Central Bank, which was integral in getting the M-Pesa deposits insured, as well as the regulatory approval. The Central Bank insures M-Pesa deposits in the banking system under its Deposit Protection Fund.

The government was actively committed to M-Pesa and the Central Bank's post-audit endorsement of M-Pesa was also a measure of political support.

Public confidence

Immediately after the programme’s rollout, despite Safaricom being a trusted brand, public confidence in the project was low, due to a fear of fraudulent activities. When SMS receipts were delayed or lost, customers would often accuse the agents of fraud and quickly complain to Safaricom. This has improved and customers are now accustomed to transacting with agents. Overall, the Kenyan public’s trust gradually has increased as awareness of the positive impacts of the service has grown.Clarity of objectives

M-Pesa's goals were clearly defined and measurable and have been maintained since its launch:

- To achieve a target of 200,000-300,000 users in Kenya.

- To attain monthly target income of a minimum of KES 40,000 (which means aim of achieving approximately 2,667 transactions monthly or 90 transactions daily).

Strength of evidence

The idea of a mobile currency originally came from DFID researchers in the UK, who noticed that Kenyans were transferring mobile airtime as a proxy for money and suggested that Vodafone launch mobile currency services in Kenya. A pilot project was rolled out in 2005 to check the feasibility of such a service.Feasibility

The 2005 clearly established technical feasibility, but there were outstanding HR and legal concerns:

- There was a need for agent training and management.

- One of the key challenges facing Vodafone/Safaricom at this stage was that of financial regulation - as M-Pesa was not a banking service it was outwith financial regulations in Kenya. There were particular concerns in the banking sector that it could be used as for money laundering channel.

However, these regulatory issues were addressed through negotiations with the Central Bank and were seen to be outweighed by the positive user reaction.

Management

The project has an efficient team from different backgrounds, and there is an established hierarchical network of agents within the team. M-Pesa has a clear structure with defined roles and responsibilities, including a training mechanism to ensure competence.

Safaricom had developed a local team to manage M-PESA operations. The team consists of over 20 individuals from a range of relevant backgrounds. The company hired an external agency to manage the agent network, and regularly relies on over 50 staff to train and visit agents. There is a department dedicated to providing training materials sessions.

M-Pesa retail agents are responsible for registering new customers and facilitating cash deposits and withdrawals. Retail agents often play a key role in customer support as they are able to quickly and easily contact M-PESA Customer Care.

There are master agents, ‘airtime wholesalers', who purchase airtime directly from the operator and manage the retail agents. Master agents create accounts in banks that are located near their retail agents, and the retail agents usually visit the nearest bank branch daily to either deposit or withdraw cash from their account.

There is a Safaricom sales team which manages the master agents and reconciles payments for airtime pickup. Bank branches manage cash and M-Pesa float balances for a group of retail agents but do not have a customer-facing role. However, customers can transfer funds between their bank M-Pesa accounts, usually through ATMs.

Measurement

There were no established measurement methods for the public impact. The company gauges M-Pesa’s impact based on the broad indicators of the number of annual transactions (currently about 240 million) and the number of registered users (roughly 20 million).Alignment

M-Pesa has been well aligned with the requirements of the Kenyan central government and central bank as well as the UK government through DFID.

Safaricom established a useful network to launch the M-Pesa initiative in Kenya. The company received technological and funding support in carrying out the pilot and establishing their services. There was strong coordination between all the agents involved in the network. However, there were some problems within the alignment of the customers and the agencies, which were eventually resolved.

Banking partners are the foundation of the M-Pesa service, and Safaricom has secured alliances with all the countries' major banks, and has an agreement with Western Union for international money transfers.

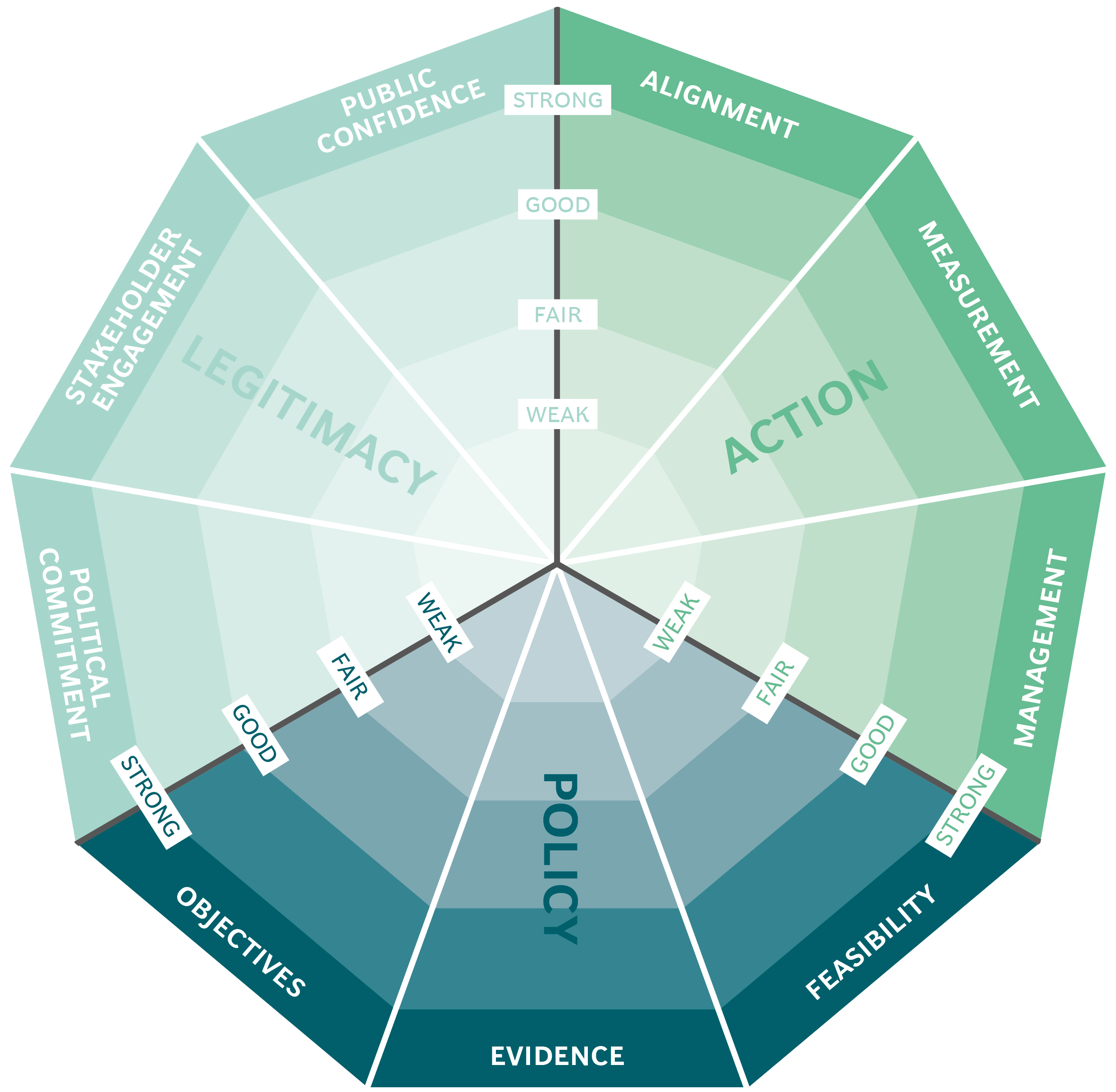

The Public Impact Fundamentals - A framework for successful policy

This case study has been assessed using the Public Impact Fundamentals, a simple framework and practical tool to help you assess your public policies and ensure the three fundamentals - Legitimacy, Policy and Action are embedded in them.

Learn more about the Fundamentals and how you can use them to access your own policies and initiatives.

You may also be interested in...

National portal for government services and Information: gob.mx

BANSEFI: promoting financial inclusion throughout Mexico

Formalising the appointment and compensation of Chile’s senior civil servants

The eco-friendly façade of the Manuel Gea González Hospital tower in Mexico City